wichita ks sales tax calculator

Sales how much calculator User Name. Cost of Living Indexes.

Kansas Sales Tax Update Remote Seller Guidance Wichita Cpa

You can find these fees further down on the page.

. There are also local taxes up to 1 which will vary depending on region. The Wichita County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Wichita County Kansas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Wichita County Kansas. Burghart is a graduate of the University of Kansas.

Enter your info to see your take home pay. Tax Information entered into the Tax Calculator is not stored or saved on a server or your. Fast Easy Tax Solutions.

DO NOT push any buttons and you will get an information operator. The median property tax on a 7680000 house is 80640 in the United States. Wichita KS Sales Tax Rate Wichita KS Sales Tax Rate The current total local sales tax rate in Wichita KS is 7500.

The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. How much tax wichitans pay on. Taxes in Kansas City Kansas are 35 more expensive than Wichita Kansas.

What is the sales tax rate in Wichita Kansas. The state sales tax rate in Kansas is 65. Wichita Kansas and Kansas City Kansas.

Wichita County KS Sales Tax Rate The current total local sales tax rate in Wichita County KS is 8500. Sales Tax State Local Sales Tax on Food. Wichita is in the following zip codes.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes. The Wichita sales tax rate is. In many areas however the actual rate paid on purchases is higher than that thanks to county.

The December 2020 total local sales tax rate was also 7500. 2022 Cost of Living Calculator for Taxes. Password Please register to participate in our discussions with 2 million other members - its free and quick.

Modernization Fee is 400. Grocery tax rate in wichita. Sales Taxes Amount Rate Wichita KS.

This will be collected in the tag office if the vehicle was. The Kansas sales tax rate is currently. The County sales tax rate is.

The December 2020 total local sales tax rate was also 8500. Sales Tax Breakdown Wichita Details Wichita KS is in Sedgwick County. Price of Car.

Your household income location filing status and number of personal exemptions. Some forums can only be seen by registered members. The median property tax on a 7680000 house is 137472 in Wichita County.

Ad Find Out Sales Tax Rates For Free. Kansas is ranked 943rd of the 3143 counties in the United States in order of the median amount of property taxes collected. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law.

Kansas Sales Tax Calculator You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code. The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used. Exact tax amount may vary for different items Download all Kansas sales tax rates by zip code The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales tax.

Tax credits itemized deductions and modifications to income are beyond the scope of the Tax Calculator. 67201 67202 67203. For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000.

Forums Kansas Wichita. Income tax rates in Kansas are 310 525 and 570. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The minimum combined 2022 sales tax rate for Wichita Kansas is. Sales and use tax Retail ecommerce manufacturing software Consumer use tax Buyer-owed taxes.

If you have any questions regarding sales tax exemption please contact Loretta Knott at LKnottwichitagov or by phone at 316-268-4636. This is the total of state county and city sales tax rates. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle.

Title and Tag Fee is 1050. Wichita KS 67213 Kellogg Tag Office 5620 E Kellogg Dr. City-Data Forum US.

The median property tax in Wichita County Kansas is 1375 per year for a home worth the median value of 76800. The median property tax on a 7680000 house is 99072 in Kansas. Real property tax on median home.

SmartAssets Kansas paycheck calculator shows your hourly and salary income after federal state and local taxes. There are no local income taxes on wages in the state though if you have income from other sources like interest or dividends. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. See how we can help improve your. This will start with a recording.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. S Kansas State Sales Tax Rate 65 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the Wichita County Sales Tax Calculator or compare Sales Tax between different locations within Kansas using the Kansas State Sales Tax Comparison Calculator. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Wichita KS.

Wichita County collects on average 179 of a propertys assessed fair market value as property tax. One of a suite of free online calculators provided by the team at iCalculator. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

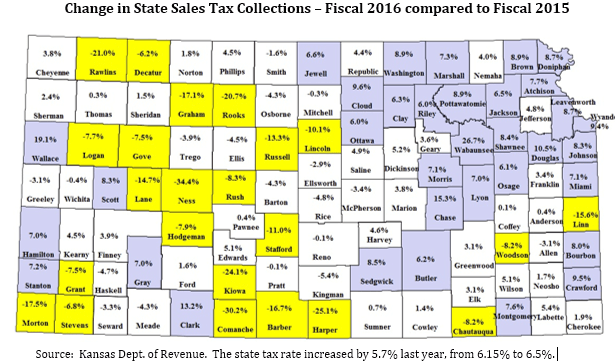

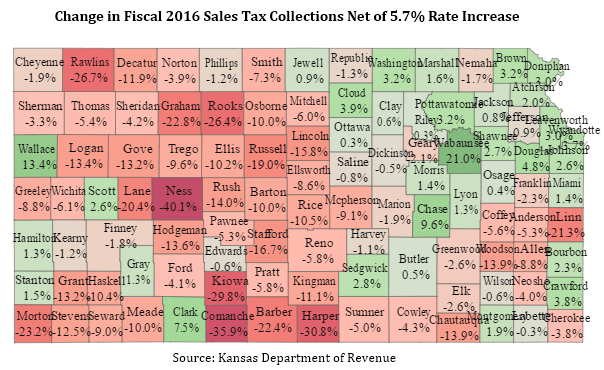

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute

Kansas Sales Tax Guide And Calculator 2022 Taxjar

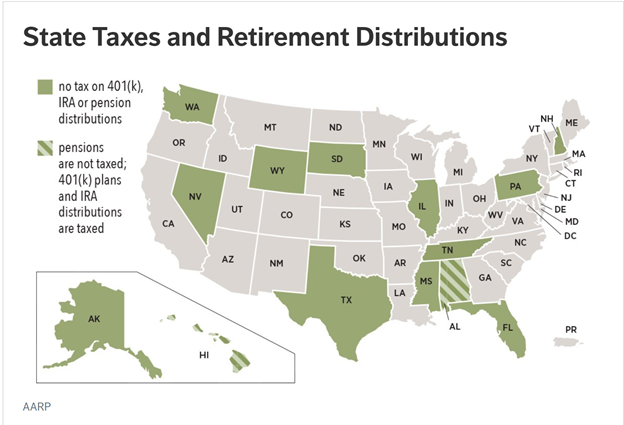

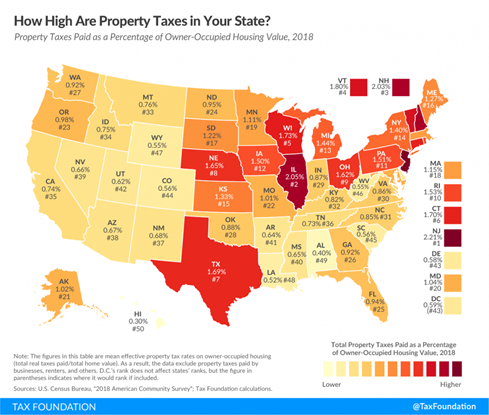

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

What Is Texas Sales Tax Discover The Texas Sales Tax Rate For 254 Counties

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Gov Kelly Gets Grocer Support To Eliminate Food Sales Tax

Kansas Sales Tax Rates By City County 2022

File Sales Tax By County Webp Wikimedia Commons

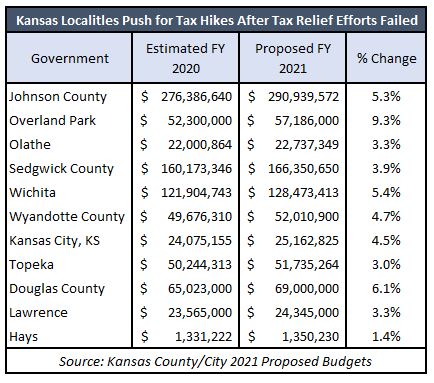

Kansas Counties And Cities Hike Taxes Amidst Covid Recession Kansas Policy Institute

Kansas Income Tax Calculator Smartasset

Dodge City Sales Tax Dodge City Use Tax Dodge City Cpa

Texas Sales Tax Calculator Reverse Sales Dremployee

Oil Farming Suppress Sales Tax Collections Kansas Policy Institute